This is an interesting thought experiment. Is the current Ethereum unforkable? Do all the Decentralized Finance products and instruments built on top of it make an Ethereum fork an instrument of the past? Also, in the rare case of a hard fork, do the backers of the stablecoins DeFi depends on hold too much power? A staple of decentralization, a fork is one of the instruments with which to obtain consensus. Also, “by creating a new fork, a minority coalition can effectively secede from the majority.”

Related Reading | Old Doge, New Tricks: Is This Still The Year Of The Doge?

Let’s analyze Haseeb Qureshi and Leland Lee’s “Ethereum is now unforkable, thanks to DeFi,” and then you can all decide for yourself if they have a case or not. But first…

What Is A Hard Fork, Exactly?

Both Ethereum Classic and Bitcoin Cash came into existence after a hard fork. When the community of developers behind a decentralized project comes to an impasse, this extreme measure comes into play. For a definition, let’s quote Investopedia:

A hard fork is when nodes of the newest version of a blockchain no longer accept the older version(s) of the blockchain; which creates a permanent divergence from the previous version of the blockchain.

The key characteristics of a hard fork are:

-

A hard fork refers to a radical change to the protocol of a blockchain network that effectively results in two branches, one that follows the previous protocol and one that follows the new version.

-

In a hard fork, holders of tokens in the original blockchain will be granted tokens in the new fork as well, but miners must choose which blockchain to continue verifying.

An unforkable decentralized project would need another tool to make radical changes.

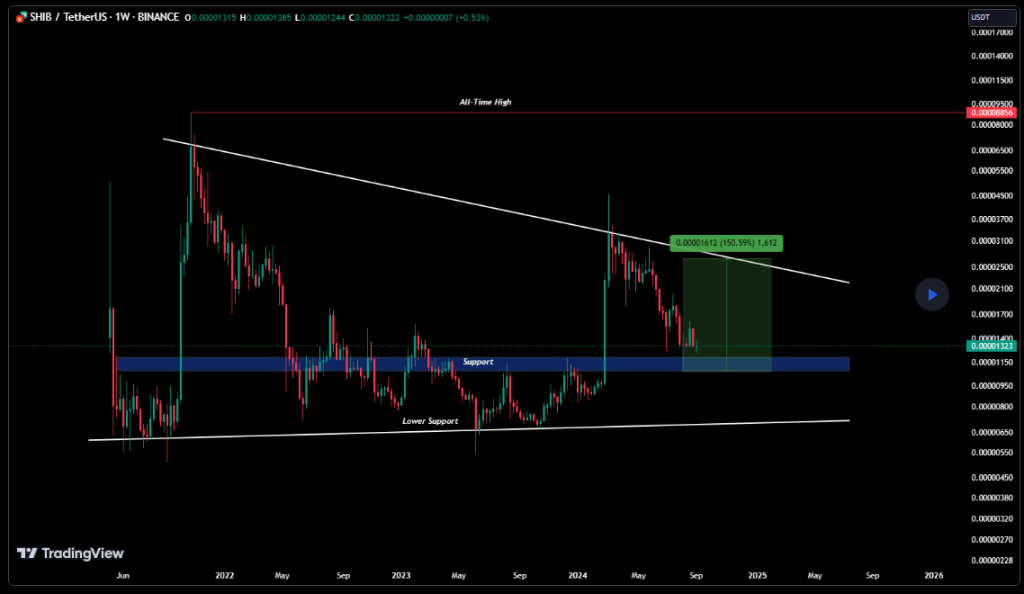

ETH price chart for 08/14/2021 on Bitfinex | Source: ETH/USD on TradingView.com

Do Stablecoins Hold Too Much Power Over DeFi

The hard fork that created Ethereum Classic was on July 30th, 2015. Decentralized Finance wasn´t even an idea. Nowadays, the Ethereum blockchain hosts hundreds of DeFi projects. Where are those projects going to go if the chain breaks in two? Could the developers maintain two versions? And, more importantly, would they want to? All of those ideas come into play in the authors’ case for Ethereum being effectively unforkable.

However, their most compelling point concerns stablecoins. Even though it’s conceivable that some of the other projects could maintain two versions, one in each blockchain, in the case of stablecoins this is simply not possible. In the thought experiment, the authors use CENTRE’s USDC.

USDC is a system of record for dollar-backed IOUs. Only one system of record can correspond to the real liabilities of CENTRE, and so the USDC ledger is effectively meaningless on the other chain.

And take into account that “USDC represents 99% of all fiat-backed stablecoins locked in DeFi applications.” There are other stablecoins that could take its place, but, “given how deeply entangled it all is, it’s incredibly challenging to extricate it quickly and safely.” These are active financial instruments we’re talking about, each individual case with its own characteristics and stipulations. It’s not unreasonable to speculate that:

“DeFi operators would have no choice but to side with CENTRE and throw all of their weight behind the USDC-blessed fork, regardless of where community opinion came down.”

The incentives are undeniable, “all of DeFi is forced to move together.”

So, Does DeFi Make Ethereum Unforkable?

According to the authors’ case, DeFi operators would be forced to leave the minority chain. Everything would be broken there. There would be little to no liquidity. Most of them would try to sell new coins created, but, would there be a demand for them?

All centralized stablecoins are now worthless. Tether, USDC, TUSD, PAX, all gone. Most operators freeze the contracts, making the tokens now untransferable and unredeemable. For smaller stablecoins, no one even bothers.

The minority chain would be born dead, “There’s no one to even bother rebuilding for.” Does that make Ethereum effectively unforkable? Check the original article for specific examples with real-life projects.

Unlike Bitcoin, whose ledger is simple enough that forks are functionally airdrops, ETH’s ecosystem is incredibly complex. Because its applications are intertwined with unforkable components, the entire system is rendered unforkable. Any minority fork is doomed to obscurity.

Of course, the unforkable conundrum is also present in all of the smart-contracts-enabled blockchains that build directly over the first layer. However, since Ethereum is the biggest and the one that hosts the most projects, let’s keep the discussion there.

Related Reading | A Recap Of Regulatory Season In Crypto

What do you all think? Do the authors make a compelling case or are they missing something? Is Ethereum unforkable? Is a hard fork absolutely necessary for a decentralized project’s governance? Or can those projects keep on trucking regardless?

All very interesting questions. The next stage of the decentralized Internet project promises non-stop action and drama.

Featured Image by Remi Moebs on Unsplash - Charts by TradingView