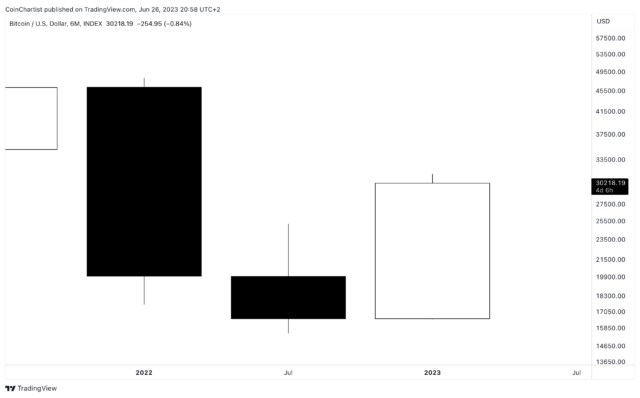

In a Telegram message to CoinDesk, Strahinja Savic, head of data & analytics at crypto-focused, institutional capital markets and advisory platform FRNT Financial, noted that stocks and cryptos had fallen together instead of diverging as they have over the past couple of months. “Today crypto dips with risk assets, tomorrow it may not,” Savic wrote. “What we can say is that the technical range has been clearly set between a downside range of $25K to $26K, and a breakout would occur decisively above $31K. Most other activities are likely noise.”