According to a recent filing, the United States Securities and Exchange Commission (SEC) has opened a comment period on Nasdaq’s proposal to allow options trading on BlackRock’s Bitcoin spot ETF (exchange-traded fund).

Options Trading On BlackRock’s Bitcoin ETF Could Come Before February End: Analyst

On Friday, January 19, the SEC acknowledged the proposal by Nasdaq to list and trade options on BlackRock’s Bitcoin spot ETF. The financial regulator asked for public comments over a 21-day period on Nasdaq’s application for options trading on BlackRock’s iShares Bitcoin Trust (IBIT).

A part of the filing read:

The Exchange proposes to amend Options 4, Section 3, Criteria for Underlying Securities, to allow the Exchange to list and trade options on iShares Bitcoin Trust (the “Trust”) as a Unit deemed appropriate for options trading on the Exchange.

For clarity, options are derivatives that give the holders the right to purchase or sell an underlying asset at a predetermined price and time. While these financial instruments can be traded between private individuals, they may also be traded on public exchanges as standardized contracts.

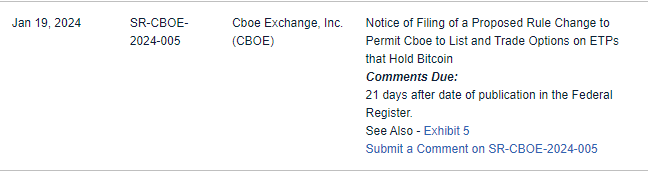

It is worth noting that Nasdaq is not the only exchange with a proposal to list and trade options on a Bitcoin ETF. The Securities and Exchange Commission also opened a 21-day comment period on Cboe’s request to options on ETPs that hold Bitcoin.

SEC acknowledges Cboe's proposal to list and trade options on Bitcoin ETP | Source: James Seyffart/X

Bloomberg ETF expert James Seyffart has offered insight on the likelihood of seeing options traded on spot Bitcoin ETFs soon. The analyst acknowledged that the SEC is moving more quickly than expected on the options proposals.

Seyffart said in a post on the X platform:

The SEC has already acknowledged the 19b-4’s requesting the ability to trade options on spot Bitcoin ETFs. This is faster than the SEC typically moves. Options could be approved before the end of February if SEC wants to move fast?

BlackRock, the world’s largest asset manager, only recently received the SEC’s approval to offer an exchange-traded fund that tracks the Bitcoin value. The firm’s iShares Bitcoin Trust became the first BTC spot ETF amongst almost a dozen competitors to record over $1 billion in inflows.

Delay On Ethereum Spot ETF?

While BlackRock’s Bitcoin spot ETF is off to a great start in the market, the trillion-dollar asset manager might need to wait a little longer to debut an exchange-traded product that holds Ethereum, the second-largest cryptocurrency.

On Thursday, January 18, the SEC announced its decision to extend the review period for Fidelity’s Ethereum ETF application. According to the regulator, this extension will afford them “sufficient time to consider the proposed rule change and the issues raised therein.”

Seyffart also commented on the recent delay of Fidelity’s Ethereum spot exchange-traded fund, saying it was “completely expected.” However, the Bloomberg Intelligence analyst earmarked late May as a critical period and a possible date for the SEC’s simultaneous approval of multiple Ether ETFs, including BlackRock’s.

Bitcoin price at $41,599 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from Getty Images, chart from TradingView

Original Source: https://bitcoinist.com/is-options-trading-on-blackrock-bitcoin-spot-etf/