Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

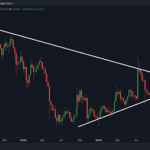

The price of XRP continues to coil just above the mid‑$2 region, but veteran market technician CasiTrades (@CasiTrades) believes the consolidation is the calm before a violent impulse higher. In a four‑hour chart published on X on 17 April, the analyst traces an Elliott Wave count showing the token finishing a textbook Wave 2 correction that began after December’s cycle high near the 0.118 Fibonacci band at $3.40.

XRP Breakout In April Still Possible

From the peak labelled (1), XRP has followed a sharp, three‑legged A–B–C pullback (drawn in gold). Leg A bottomed in February at $1.77. Leg B retraced to the 0.236 level at $2.99 before the current slide in Leg C, which has thus far defended the 0.618 retracement at $1.54. Below lies a thick liquidity pocket between the 0.618 and 0.65 retracements—$1.55 to $1.45—highlighted by a green box on the chart.

CasiTrades describes that zone as “the most likely target” for any final sweep lower, but stresses that price “has shown solid support at the 0.5 retrace ($1.90). On the macro timeframe, not much has changed.”

Related Reading

The chart also flags the 0.382 retracement at $2.24 with a red line—the final ceiling that must be reclaimed to confirm bullish reversal. “To break major resistance at $2.24 (the 0.382), we’ll likely need one final push off either $1.90 or $1.55. If XRP clears and holds $2.24, these lower levels become far less likely,” the analyst writes. The market has already printed a series of higher lows on the four‑hour Relative Strength Index while price carved lower lows, producing a clear bullish divergence that reinforces the idea that selling pressure is exhausting.

CasiTrades argues that the macro structure remains intact: the decline of the past four months is Wave 2 inside a much larger five‑wave advance. “We are very close to ending this correction, whether the low is already in or we need one more support test, I still believe we’re about to enter macro Wave 3,” she notes.

Under classical Elliott guidelines, one wave of every impulse must extend, and the analyst expects that role to fall to Wave 3. Using Fibonacci expansion from the Wave 1 impulse—the vertical purple projection—she derives upside objectives at the 1.618, 2.618 and 3.618 extensions: $6.50, $9.50 and “$12+” respectively.

“One wave must extend in every impulse and most likely this will happen on Wave 3. This isn’t hype, this is textbook Fibonacci + Elliott Wave logic. Correction bottom is either here or very near. Once Wave 3 begins, it only takes weeks, not months,” she explains.

Related Reading

Sceptics questioned whether algorithmic manipulation might have invalidated traditional tools, but the analyst remains unmoved. “This price action has been frustrating, but I believe the market is largely driven by algos that to complete specific patterns, these patterns make money for their creator. Strong demand may be delaying the final push lower, but I still believe the market likely needs to test those support levels to grab liquidity before a breakout. We’re at a critical test right now. If buyers can push the price above $2.24, it could shift the algos instead of hunting lower, they may flip direction and chase momentum.”

Time, she insists, is running out for bears. “We’re mid‑April now. If XRP tags that final support, even by the end of this week, and volume steps in, a breakout to new highs could very realistically kick off in late April and still satisfy the April breakout outlook.”

As of press time XRP is trading near $2.16 on Binance, only a few percentage points below the critical $2.24 trigger.

Featured image created with DALL.E, chart from TradingView.com

Original Source: https://www.newsbtc.com/xrp-news/xrp-breakout-still-likely-april-12/

Leave a Reply