As US President Donald Trump’s baseline 10% trade tariffs went into effect this week, global equity and crypto markets — including Bitcoin (BTC) — took a beating. While the Dow Jones Industrial Average is down more than 9% over the past five days, the total crypto market cap has shed approximately $150 billion over the last week, with the majority of losses concentrated in altcoins.

Bitcoin Remains Resilient Despite Tariff Uncertainty

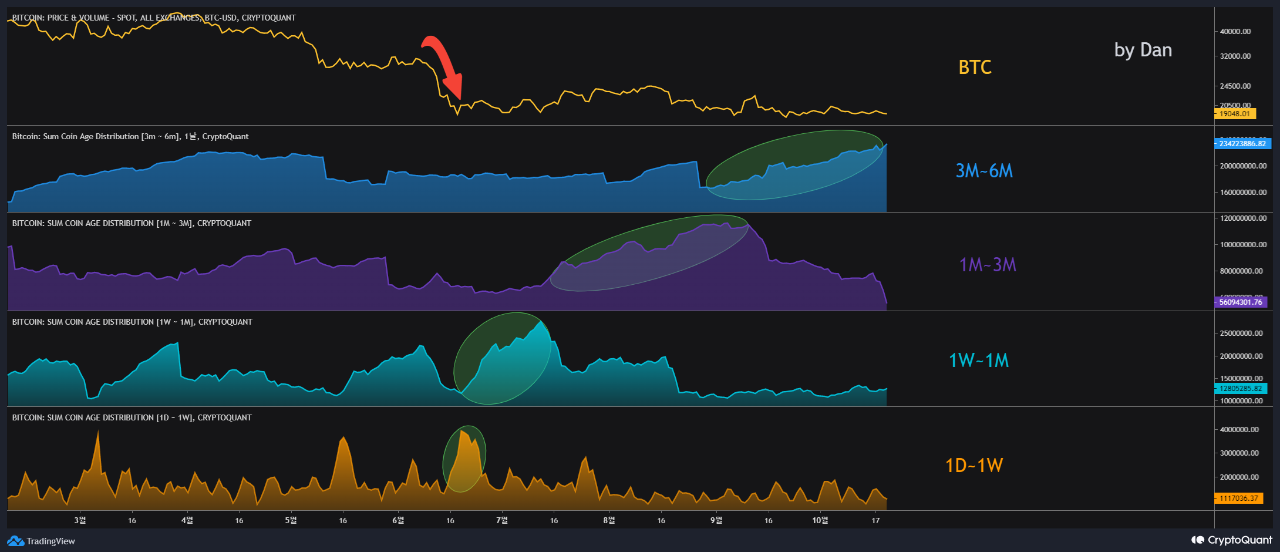

In a report released yesterday, Binance Research highlighted that despite rising risk-off sentiment triggered by the tariffs, BTC has held up relatively well compared to other digital assets. For context, BTC has declined by 19.1% since the tariff announcement, while Ethereum (ETH) has dropped by 44.1% over the same period.

Other narrative-driven digital assets, such as memecoins and artificial intelligence (AI) tokens, have seen even steeper declines – plunging 58.1% and 52.5%, respectively. In contrast, traditional safe-haven assets like gold have continued their upward trajectory, setting multiple new all-time highs amid rising macroeconomic uncertainty.

The implementation of trade tariffs has reignited discussions around the correlation between BTC and equities. When tariffs were first announced on January 23, the 30-day correlation between the two asset classes stood at -0.32. However, as tariff announcements continued, the correlation rose to 0.47 by March, suggesting a temporary alignment of BTC with broader risk sentiment.

That said, the report notes that “Bitcoin’s correlation with traditional markets tends to rise during acute stress but fades as conditions normalize.” It further highlights that BTC has shown “some signs of resilience” amid the recent macro shocks.

Additionally, long-term holders continue to accumulate BTC. According to Binance Research, these investors have displayed conviction and minimal capitulation during recent volatility — signaling that Bitcoin may be moving toward a more independent macro identity.

How Will BTC Fare In A Protectionist World?

If Trump’s tariffs persist, they could present a new challenge for the cryptocurrency market. Investor sentiment may weaken further amid growing fears of a recession. Rising import costs could also push inflation higher, reinforcing concerns around potential stagflation.

However, a recession combined with sluggish economic growth might eventually compel the US Federal Reserve to aggressively cut interest rates and reintroduce quantitative easing – a move that could benefit risk-on assets like BTC.

Moreover, recent analysis from crypto analyst Titan of Crypto suggests a potential rally in BTC as the global M2 money supply appears poised to expand. Historically, Bitcoin’s price tends to follow increases in M2 with a lag of approximately 70 to 107 days. At press time, BTC trades at $79,989, up 3.6% in the past 24 hours.

Featured Image from Unsplash.com, charts from Binance Research and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Original Source: https://bitcoinist.com/bitcoin-has-shown-signs-of-resilience-amid-tariff-uncertainty-binance-research/