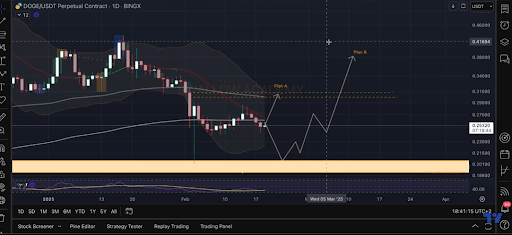

Dogecoin’s price action with the Bollinger Bands indicator shows it is now at a junction of either a breakout to the upside or another downward move. Technical analysis shows that Dogecoin’s interaction with the Bollinger Bands suggests it could go on a swift upwards move. However, there remains a critical risk factor that the bulls need to keep an eye on.

Dogecoin’s Struggle Around The Middle Bollinger Band

Dogecoin’s price action with the Bollinger Bands was noted on the TradingView platform by crypto analyst SwallowAcademy. SwallowAcademy’s analysis highlights that since the start of February, Dogecoin has been trading within the Bollinger bands, but not without turbulence. A price crash in early February saw Dogecoin break below the lower Bollinger band on February 3 with a strong wick. However, it has since recovered and is now back trading within the Bollinger bands.

Typically, such a move is followed by a rally toward the middle Bollinger band, which has indeed happened. Instead of continuing into a full-fledged bullish trend, DOGE has faced resistance at the middle band. This shows that there’s either a lingering selling pressure or a lack of strong buying pressure.

This behavior is unusual compared to Dogecoin’s price action this cycle, where it would typically see a reversal to the middle band and then a continued move toward the upper Bollinger band. Instead, the cryptocurrency remains stuck around the middle band, struggling to break through convincingly. As noted by the analyst, the key test now is whether the meme coin can break past this resistance, which could cause a rally of at least 15%.

The Danger Level To Watch For DOGE Bulls

The bullish plan is for Dogecoin to break above the middle Bollinger band and then aim for the upper band. If Dogecoin manages to hold support and push beyond the middle Bollinger band resistance, the bullish outlook remains intact. Breaking past this level would likely cause a return above $0.30. From here, there could be a stronger move toward the $0.40 price level, which would then confirm a continuation of the larger uptrend. However, there is a critical risk factor that bulls need to keep an eye on.

There’s a possibility of a deeper retest before a major breakout that cannot be ignored. The analyst noted that following Dogecoin’s explosive breakout in November 2024, there was no proper retest of a key resistance zone within that rally. As is the nature of cryptocurrencies, such gaps tend to get revisited, meaning there is a possibility that DOGE could decline to retest the unfilled order block.

If this scenario plays out, Dogecoin could drop to as low as $0.20 again. A successful retest of this zone could then lay the foundation for a significant breakout to the predicted $0.4 target.

At the time of writing, DOGE is trading at $0.2534.

Featured image from Adobe Stock, chart from Tradingview.com

Original Source: https://bitcoinist.com/dogecoin-bollinger-bands/