Ether’s (ETH) underperformance as an asset has continued to spark criticism and speculation in the crypto community, with many expressing their displeasure at the Ethereum network’s current trajectory.

Quinn Thompson, founder of the discretionary macro hedge fund Lekker Capital, insists that ETH is now completely dead as an investment. While some analysts and market participants do not agree with him, others concur with him, giving reasons for their opinions.

ETH is Dead as an Investment

To substantiate his stance, Thompson mentioned that ETH, an asset with a market cap of $225 billion, is seeing a decline in transaction activity, user growth, fees, and revenue. Although the Ethereum network still has utility, he believes it is dead as an investment.

“There is no investment case here. As a network with utility? Yes. As an investment? Absolutely not,” the Lekker Capital founder stated.

In alignment with Thompson’s view, Nic Carter, co-founder of blockchain data aggregator Coinmetrics and partner at the blockchain venture capital firm Castle Island Ventures, explained why ETH is dead as an investment.

According to Carter, the main reason is that greedy Ethereum layer-2 networks are siphoning value from the blockchain, and that there is a social consensus that the creation of excess tokens in the Ethereum ecosystem is okay. The analyst said ETH died by its own hand because it had been buried “in an avalanche of its own tokens.”

Analysts Blame L2s, VCs, Bitcoin Maxis

Responding to Carter’s tweet, Thompson asserted that the social consensus that found the excess token creation okay happened because the emergence of endless layer-2 chains, staking, and restaking protocols enriched the pockets of developers and team members. However, now that the situation has turned awry, no one wants to admit that the concept was wrong, especially with the market saying it was a mistake.

Furthermore, a pseudonymous analyst insisted that “Solana scammers” and Bitcoin maximalists cheered the creation of excess tokens on Ethereum. Since venture capitalists could not “shill” ETH, they had to sponsor the development of infinite layer-1 networks so they could dump on retailers.

“If we would all come together around ETH as a community, it would be inherently strong and wouldn’t need outside banks or institutions. But bitcoin maxis were and are too afraid of it because it’s everything bitcoin(number go up and down coin) wants to be,” the analyst said.

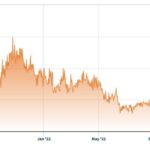

At the time of writing, ETH was worth around $1,830, having lost almost 50% of its value from a year ago.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Original Source: https://cryptopotato.com/is-eth-dead-as-an-investment-analysts-weigh-in/