In a recent regulatory filing, business intelligence firm Strategy disclosed the potential risk of selling its massive Bitcoin holdings to meet debt obligations.

The company, which has been known for its aggressive Bitcoin acquisition strategy, may have to abandon its founder Michael Saylor’s longstanding “never sell BTC” pledge if market conditions persist.

Strategy Faces Liquidity Issues

Strategy has accumulated 528,185 BTC, with an average purchase price of $67,458, totaling $40,119 billion in value as of the filing date, and touts itself as the largest BTC-treasury company. Its last Bitcoin acquisition was on March 30th. However, the significant drop in the cryptocurrency’s market price has created an unrealized loss of nearly $6 billion for the first quarter of 2025.

The Form 8-K filing with the US Securities and Exchange Commission (SEC) read,

“As bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable.”

The NASDAQ-listed company highlighted the potential liquidity issues it faces due to a combination of its heavy reliance on the world’s largest cryptocurrency as its primary asset and a lack of sufficient cash flow from its software business. Strategy has accumulated over $8 billion in debt, including substantial annual interest payments and dividend obligations on its preferred stock.

These financial pressures could force the company to liquidate its BTC holdings at a loss should it fail to secure timely financing through equity or debt.

The filing also outlined the risks tied to its Bitcoin strategy. The volatility of the asset’s price has contributed to a significant unrealized loss in digital assets, which could further exacerbate its financial struggles if the market value of the token continues to decline.

Despite adopting new accounting standards that allow for the fair valuation of Bitcoin, the company faces ongoing challenges in balancing its massive digital asset portfolio with its financial obligations.

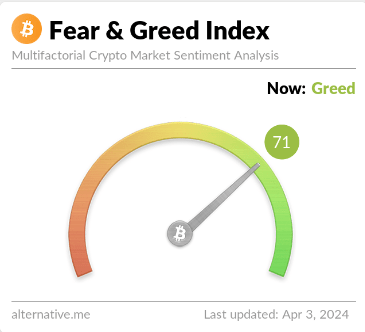

Trump’s Tariff Impact on Crypto

Bitcoin dropped under $75,000 earlier this week but managed a slight recovery later in the day as President Trump’s new global tariffs came into play. Several top tokens experienced similar declines. The retreat of traders from major cryptos erased the gains made during Tuesday’s brief rally as Trump continued to press ahead with his aggressive changes to global trade.

Meanwhile, tariffs on Chinese imports were raised to 104%, and import taxes were also increased for over 60 other trade partners.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Original Source: https://cryptopotato.com/strategys-bitcoin-holdings-at-risk-may-sell-btc-to-meet-obligations/