What is Terra?

Terra is a decentralized proof of stake blockchain network. The network is supported by a basket of algorithmic stablecoins which are pegged to fiat currency. Further, there is in-house governance and staking token called LUNA. The project has been developed by TerraForm Labs, Seoul, South Korea.

How scalable is the Terra Network?

Despite being a layer one blockchain, Terra can scale up to 10,000 Transactions Per Second (TPS) with a block time of six seconds.

What are all integrations available with Terra Network?

Applications

| Mirror Protocol | DeFi protocol to enable the creation of synthetic assets |

| Anchor Protocol | High yield savings protocol |

| Chai | Payments platform in South Korea |

| Buzlink | Marketing product to scale social referrals |

| Memepay | Payments platform in Mongolia |

| PayWithTerra | A platform for merchants to accept Terra Stablecoins |

Wallets

- Terra Station

- Chrome extension

- Desktop version (for MAC, Windows, and Linux)

- Mobile App (iOS and Android)

- Mirror Wallet

- Math Wallet

- Ledger Nano X / S

- Oxis Wallet

Exchanges (for LUNA and Terra Stablecoins)

What is LUNA?

LUNA is the native token of the Terra Network. It is the foundational asset of the entire ecosystem. By collateralizing LUNA, the Terra network achieves the price stability of Terra Stablecoins. In the future, Terra’s transaction volume would determine the value of LUNA.

LUNA staking rewards

Terra’s value chain is based on LUNA. The supply of stablecoins is control by the value of staked LUNA coins. For Example, in case of an increase in the demand for stable coin UST (Terra USD), to ensure the stability of the price of UST, the Terra network would mint more UST. To mint UST, equal the value of LUNA tokens that are staked should be burned, thus leading to an increase in the value of LUNA.

An average of 10.67% per annum can be earned by staking LUNA.

In short, an increase in the demand for Terra stablecoins would lead to a decrease in the supply of LUNA and would increase its market value.

Staking rewards provided to the stakers come from the following sources:

| Source of Revenue | Description |

| Gas Fees | Gas fee is the network fee charged by the platform for validating a particular transaction. |

| Taxes | Tax is a form of stability fee charged on each transaction ranging from 0.1% to 1% (capped at 1 TerraSDR) |

| Seigniorage Rewards | The oracle process of Terra network provides rewards to the participating validators from the Seigniorage Pool. |

Who are Validators?

Validators are the network participants who run a full note of the Terra Blockchain Network. They play the most crucial role in the network consensus mechanism.

Who are LUNA Delegates?

LUNA token holders cannot stake their tokens directly on the network. They would delegate their tokens to a validator. Once they delegate their token to a network validator, they would receive a token bLUNA (Bonded Luna). This is a kind of receipt of LUNA tokens being bonded.

The network allows only the top 100 validators (based on the value of bonded LUNA) to sign a block. Thus, these top 100 validators make the transaction validating set known as delegates.

What are the use cases for LUNA Token?

1. Staking to validate blocks on the network

2. Staking to provide price feeds

3. Keep stablecoins stable i.e., pegged to the respective fiat currency

4. Governance

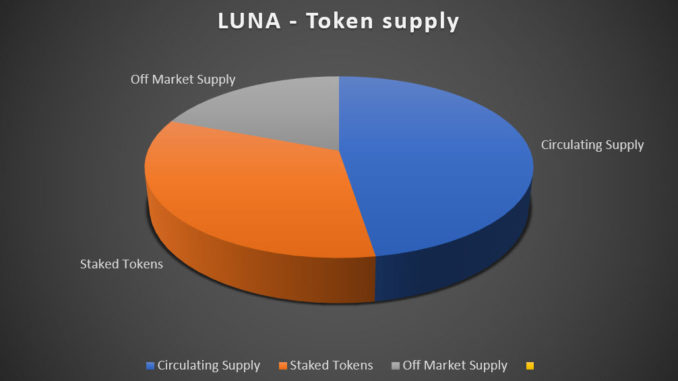

LUNA Token Supply

| Particulars | Value | Source |

| Maximum Supply | 1 Billion | |

| Total Tokens Burned | 40.02 Million | Click Here |

| Adjusted Maximum Supply | 959.97 Million | Click Here |

| Total Supply | 959.97 Million | |

| Circulating Supply | 453 Million (47% of Adjusted Maximum Supply) | Click Here |

| Market Cap | USD 6.82 Billion | Click Here |

| Price | USD 17.49 | |

| Staked Tokens | 321.21 Million (70% of the circulating supply) | Click Here |

| 24 Hour Volume | USD 742 Million | Click Here |

Initial Token Allocation

| Pre-Seed and Seed Sale | 189.5 Million |

| Genesis Liquidity | 40 Million |

| Terra Alliance | 200 Million |

| TerraForm Labs | 144.386 Million |

| Stability Reserve | 200 Million |

| Employees & Contributor Pool | 128 Million(to be increased to 201.4 Million by May 31, 2022) |

| Private Sale | 18 Million |

Benefits of LUNA

- High number of Transactions Per Second (TPS). 10,000 Transactions Per Second (TPS)

- Synchronization of a stable payment system (stablecoins) and growth mechanism (LUNA)

- A high percentage of tokens staked Vs. circulating supply

Possible Limitations of LUNA

- Dilution in value with a future increase in the market circulating supply

- Limited number of validators may take over the network for malafide intentions

Useful Links:

Harsh Agrawal is the Crypto exchange and bots expert for CoinSutra. He founded CoinSutra in 2016, and one of the industry’s most regarded professional blogger in the fin-tech space.

An award-winning blogger with a track record of 10+ years. He has a background in both finance and technology and holds professional qualifications in Information technology.

An international speaker and author who loves blockchain and crypto world.

After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra.

Join us via email and social channels to get the latest updates straight to your inbox.

Page Contents

Original Source: https://coinsutra.com/terra-network-luna-token-analysis/#utm_source=rss&utm_medium=rss&utm_campaign=terra-network-luna-token-analysis